By Kevin Judge | July 16, 2018

The US is enjoying an economy that promises to grow at rates not seen in decades, with the prospect of low unemployment and rising wages.

The US is enjoying an economy that promises to grow at rates not seen in decades, with the prospect of low unemployment and rising wages.

Before we pop the Champagne corks, there are economic headwinds blowing that will certainly slow the economy. In a worst-case scenario, they could trigger a recession and spoil our party completely. There are three troubling trends that we need to watch.

Rising Interest Rates

The Federal Reserve has raised its benchmark interest rate for the second time this year and signaled that it may step up its pace of rate increases because of solid U.S. economic growth and rising inflation.

The Federal Reserve has raised its benchmark interest rate for the second time this year and signaled that it may step up its pace of rate increases because of solid U.S. economic growth and rising inflation.

The days of near zero percent interest rates are clearly over. This month, the Federal Reserve raised its key short-term rate from 1 ¾ to 2 percent. This is still historically low, but it is the seventh since the Fed started fighting in 2015 and more increases are on the way. The Fed expect four rate hikes this year.

Higher interest rates are consistent with a good economy because it reflects increase demand for credit by business and consumers as business activity expands. However, business and consumers will have higher borrowing costs. This can hurt business investment and harm sales of big ticket personal items such as cars and homes.

An aspect of this to watch and be concerned about is the rising cost of servicing the Federal Debt. The era of low interest rates has allowed Congress and the President to avoid make tough choices on the Federal budget, but the bill for soaring borrowing is about to come due.

Rising Energy Costs

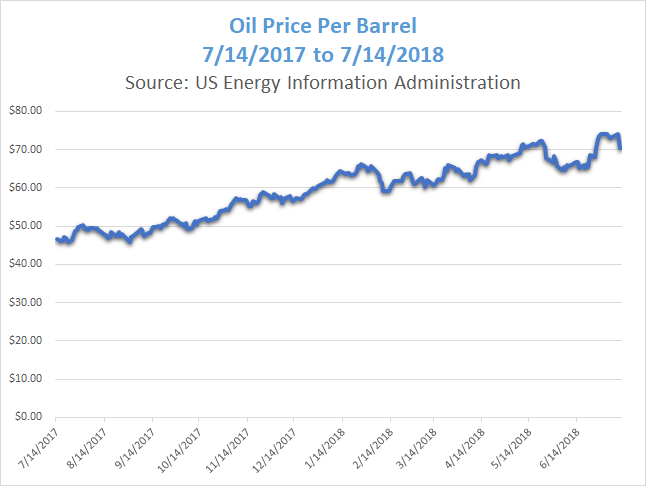

It’s not a secret that the price of oil is up. You see it every time you fill your tank. We are a far cry from the $140 per barrel high in 2008, that lead to $4.50 per gallon at the pump, but the price has been climbing steadily throughout the year.

Announcements of increase production by Saudi Arabia and other oil producers will likely help the price from going off the chart, but a growing economy demands energy.

Announcements of increase production by Saudi Arabia and other oil producers will likely help the price from going off the chart, but a growing economy demands energy.

Recently the director of the International Energy Agency said “One thing is certain, while market imbalances will feed volatility, the era of cheap oil is over.”

The death of cheap oil has been reported several times, in the 80’s and 00’s, but market prices defied conventional wisdom and returned to highly affordable levels.

Oil is only part of the energy equation. Coal and natural gas are also important. Overall, the cost of providing Americans with electricity and home heating is increasing. Even cheap and abundant natural gas has risen in cost recently. Rising demand for electricity and home heating over the past year has been blamed on a colder than average winter.

Rising Inflation

Some of us still recall the sky-high inflation rates of the 1970’s. Rapidly rising prices reduce living standards and can shake confidence in the economy and the political system. Americans hate paying higher prices.

Some of us still recall the sky-high inflation rates of the 1970’s. Rapidly rising prices reduce living standards and can shake confidence in the economy and the political system. Americans hate paying higher prices.

Inflation has been low but is rising. For the first time in a long time. this month’s rate of inflation is higher than wage increases. Consumer prices were 2.9% above their year-earlier level last month, according to the Labor Department last week. High energy costs were an important fact, but the so-called core rate that excludes food and energy was also up to 2.3%.

Recession?

The worst-case scenario would likely require an additional “black swan” event, an unexpected change in circumstances. Such an event typically causes one of these factors to spike in the wrong direction.

By definition, a Black Swan is unexpected, but there a two trouble spots to watch. Trump’s tariffs and trade policies will cause some mild inflation in the short run, but could cause a lot more and harm major sectors of the economy if a trade war really heats up.

Second, as mentioned the higher interest rates impact the Federal Budget. Politicians seem to quite complacent about this considering the demands of an aging population on Social Security and Medicare. If the Fed were to lose control of interest rates, which would not be the first time, the consequences would be dire.

Overall, not likely in 2018.

Nonetheless, keep your eyes out for that Black Swan