By Kevin Judge | July 27, 2018

Economist Arthur Laffer’s “Laffer Curve” became a foundational principal of the so called “Supply Side Economics” embraced by conservatives in the 1970’s and 80’s. With a name like Laffer Curve, the jokes write themselves. That’s how liberals and liberal economists treated it, as a joke.

Economist Arthur Laffer’s “Laffer Curve” became a foundational principal of the so called “Supply Side Economics” embraced by conservatives in the 1970’s and 80’s. With a name like Laffer Curve, the jokes write themselves. That’s how liberals and liberal economists treated it, as a joke.

At the time, when I was a much younger man than I am now, it was that response that pushed me to embrace Supply Side and conservative economics. If these critics were so smart, how could they not see that the Laffer Curve was not only true but a truism? The Laffer Curve is based on three undeniably true facts.

- If Income Tax rates are set at zero percent you will collect zero tax revenue.

- If Income Tax rates are set at one hundred percent you will also collect zero revenue because no one will be willing to work without compensation.

- There is a rate in between zero and hundred percent that will bring in the most revenue, the optimum rate. A truism if I have ever heard one.

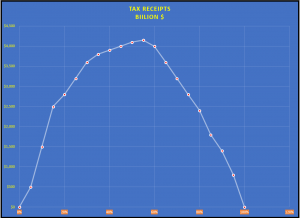

The curve refers to the fact that if you chart possible combinations of rates and results one would predict that it would produce a typical bell shape, that revenue rises as rates rise until at some point higher rates produce less revenue as they rise.

If you want to debate this, the argument is not whether the Laffer Curve exists, but what the shape of the curve is and what the optimum rate currently is. That is not an easy question to answer, but liberals refuse to even join the debate. Liberals have made it clear that taxation is not just about raising revenue to support government.

If it was, they would be pleased when lower rates produce more revenue. They haven’t been. In fact, they have consistently supported “static” forecasting that assume things like the Laffer Curve do not exist. They assume raising tax rates always produce more revenue, which has been demonstrably not true. A famous example was during HW Bush’s administration. Congress pushed through a luxury tax on the sale of yachts. It killed the sales of yachts and the decline in income tax revenue was significantly greater than the new revenue from the new tax.

Soooo, if tax rates are not just about revenue then what do liberals think they are about?

Soooo, if tax rates are not just about revenue then what do liberals think they are about?

The most illustrative answer to this question can from candidate Barak Obama in a 2008 debate with Hillary Clinton. Moderator Charlie Gibson asked about Obama’s plan to raise the capital gains rate and first explained that there is a long history of revenues increasing when the tax rate on investment sale profits goes down.

This makes perfect sense because when you tax something, sales of investments, you get less of it. Fewer sales, fewer taxes to the government. Right Barack?

-

- GIBSON: And in each instance, when the rate dropped, revenues from the tax increased; the government took in more money. And in the 1980s, when the tax was increased to 28 percent, the revenues went down.So why raise it at all, especially given the fact that 100 million people in this country own stock and would be affected?

- OBAMA: Well, Charlie, what I’ve said is that I would look at raising the capital gains tax for purposes of fairness.We saw an article today which showed that the top 50 hedge fund managers made $29 billion last year — $29 billion for 50 individuals. And part of what has happened is that those who are able to work the stock market and amass huge fortunes on capital gains are paying a lower tax rate than their secretaries. That’s not fair.

So, there you have it. Even if the investor ends up paying the government less in tax revenue, only a higher rate is “fair” because if you are rich you can afford it. Even if you pay less? What? Huh?

Higher rates on the wealthy are fair as a matter of faith, not rational economics. Or rational thought for that matter.

We are seeing this play out again. The Trump/Republican tax cuts were supposed to starve the Treasury of revenue, but tax receipts have soared to an all-time high. Yes, you can set tax rates too low. Results show we are not there yet.

Arthur Laffer upset conservatives because he supported some of Bill Clinton’s economic policies, most notably his reduction of the capital gains tax that produced so much revenue it helped to balance the budget. Laffer was a throwback to days where you could make a distinction between political ideology and economic philosophy.

During Bill Clinton’s day, many Democrats declared themselves to be socially liberal and fiscally conservative. Such Democrats are a dying species.