By Kevin Judge | June 15, 2018

One factor effecting market stability is the expectation and reality that the Federal Reserve is raising interest rates. Higher rates increase the cost of doing business and effect markets by making bonds more attractive as investments.

One factor effecting market stability is the expectation and reality that the Federal Reserve is raising interest rates. Higher rates increase the cost of doing business and effect markets by making bonds more attractive as investments.

Should we be concerned about the stock market and the economy in general?

First, some people and parts of the economy benefit from higher rates. Savers and senior citizens who live off their investments cheer rising rates. The Fed’s decade long policy of keeping interest rates at historic lows has hindered conservative investors who do not want to chase yields from high risk investments.

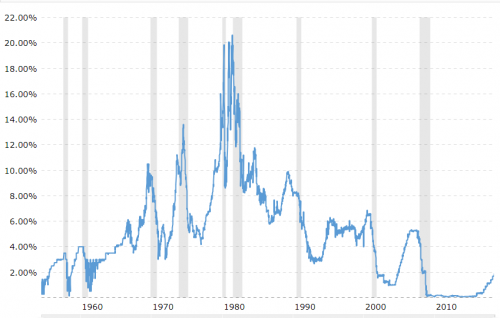

Secondly, so far, the rise in rates has been extremely modest by historic standards. As the above chart illustrates, the current Fed Funds rate of 2% is very low and does not compare with periods like the 1979-80 period where sky high rates brought on a recession. The Feds funds rate is the rate that banks lend to each other overnight from their Federal Reserve Bank accounts and is used by the Fed as a target for controlling rates overall.

The bottom line is that rising rates are important for normalizing the economy and returning to market-based yields and is not a significant short-term issue. Long term, that is another matter indeed.

The Fed will have to be careful that interest rates do not become too great a burden on the Federal Budget, but a reckoning for decades of profligate spending and the demands of retiring baby boomers may be at hand. Politicians have been able to avoid tough choices by being able to finance sky high budget deficits at historically low interest rates.

As rates rise, the choices will become even harder and the need for budget control will become more urgent. As rates rise, the potential increases for a miscalculation by the Fed that induces a recession. With the Government already running large budget deficits policy choices will be limited the consequences will range from severe to catastrophic.

Higher rates of economic growth, which leads to higher tax revenue and lower social program costs can be a big help, but not a complete solution. It would be nice if our lawmaker would find the will to deal with the “debt bomb before it goes off, but I am not holding my breath.